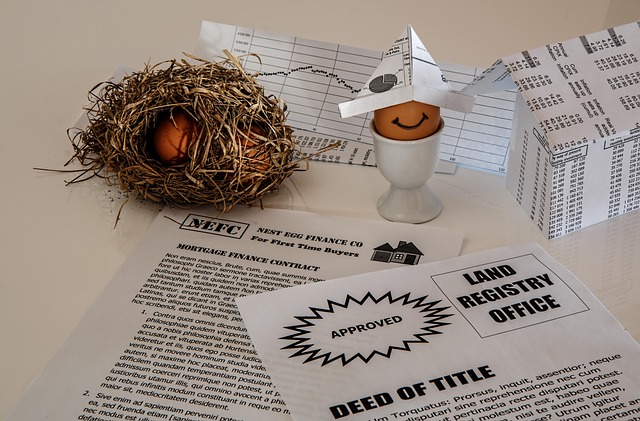

Small businesses facing financial challenges can turn to title loans for business expenses as a swift, collateral-driven solution offering same-day funding. These loans cater to urgent cash flow needs, simplify debt consolidation, and enable businesses to restock inventory and grow, appealing especially to those with limited traditional lending options.

Title loans have emerged as a powerful financial tool for businesses facing cash flow challenges. This type of secured lending offers a quick solution for covering immediate expenses and inventory restocking needs. In this article, we’ll explore how ‘title loan for business expenses’ can be strategically utilized. From understanding the process to uncovering benefits and considerations, we’ll guide you through navigating this alternative financing option. Learn how to leverage title loans effectively to maintain business momentum during tight financial periods.

- Understanding Title Loans for Business

- How to Use Funds for Expenses and Inventory

- Benefits and Considerations for Restocking

Understanding Title Loans for Business

For many businesses, especially small enterprises navigating tight financial waters, understanding access to quick capital is paramount. Enter title loans for business expenses—a unique financial solution that leverages a business’s assets, specifically their inventory and equipment, as collateral. This alternative lending approach differs from traditional secured loans like Houston title loans or title pawn, offering a streamlined process with less stringent requirements and faster turnaround times.

These loans cater to the immediate cash flow needs of businesses by providing funding based on the value of their existing inventory and assets. It’s an ideal strategy for restock and expansion during unpredictable market conditions. By tapping into this form of financing, business owners can secure the capital they need without the lengthy application processes and rigorous credit checks often associated with conventional loans.

How to Use Funds for Expenses and Inventory

When securing a Title Loan for Business Expenses, savvy business owners know how to maximize their immediate cash flow. The funds from such loans are versatile tools that can be channeled into various aspects of your operations. Firstly, they offer Same Day Funding, enabling you to cover unexpected costs or capital gaps swiftly. This could include paying for essential equipment repairs, inventory restock, or even covering urgent payroll expenses.

Moreover, a title loan can serve as a strategic tool for Debt Consolidation. If your business has multiple debts with varying interest rates, combining them into a single loan with potentially lower interest can simplify repayment and save on long-term financial burden. In Fort Worth Loans, accessing this flexible funding option allows entrepreneurs to focus on core business activities, ensuring smooth operations and growth without the constant worry of debt management.

Benefits and Considerations for Restocking

For businesses, restock is a critical component to ensure continuous operations and growth. A title loan for business expenses can offer a quick solution to fund this essential process, providing much-needed capital to purchase inventory. This alternative financing method is particularly appealing for smaller businesses or those with limited access to traditional lending options. By leveraging the value of their assets, such as vehicles or equipment, through a title transfer, entrepreneurs can gain immediate access to funds without sacrificing long-term ownership.

When considering a title loan for business expenses and inventory restock, several factors come into play. One key advantage is the flexibility it offers in terms of repayment. Interest rates vary depending on lenders and loan terms, but many provide manageable monthly installments that align with businesses’ cash flow patterns. Additionally, loan eligibility criteria are designed to be inclusive, allowing a broader range of business types and owners to access these funds. This accessibility ensures that companies can quickly restock their shelves, meet customer demands, and maintain operational efficiency.

Title loans offer a flexible financing solution for businesses in need of quick cash. By using these funds for legitimate business expenses and inventory restock, companies can maintain operations and capitalize on growth opportunities. While this alternative financing method has numerous benefits, it’s crucial to weigh the costs and terms before securing a loan. With responsible management, title loans can be a game-changer for businesses looking to navigate cash flow challenges and seize market opportunities.