Entrepreneurs using title loans for business expenses should be informed about potential pitfalls like overselling assets and hidden fees. Strategize repayment by assessing cash flow, maintaining good credit, aiming for faster loan payoff, and utilizing automated payments in San Antonio to minimize costs.

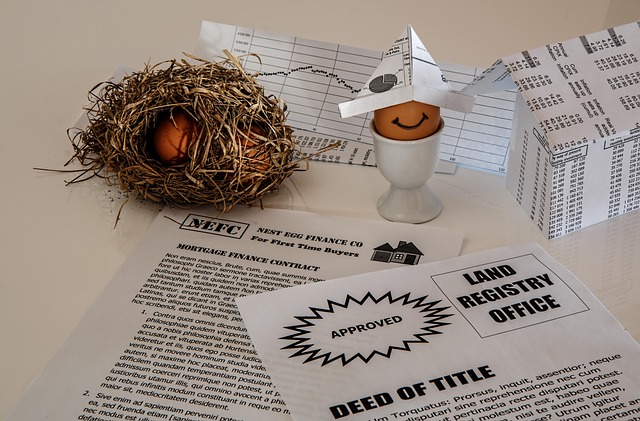

“In today’s dynamic business landscape, funding options are crucial for entrepreneurial growth. One alternative gaining traction is the title loan for business expenses. This comprehensive guide explores ‘Understanding Title Loans for Business,’ shedding light on their mechanics and potential benefits. However, as with any financial decision, there are common pitfalls to avoid. We’ll navigate through these, offering strategies for responsible repayment. By understanding these aspects, businesses can leverage title loans effectively while steering clear of potential traps.”

- Understanding Title Loans for Business: A Comprehensive Guide

- Common Pitfalls to Avoid When Taking Out a Business Loan

- Strategizing Repayment: Navigating Your Title Loan Responsibly

Understanding Title Loans for Business: A Comprehensive Guide

Title loans for business expenses have emerged as a popular option for entrepreneurs seeking quick liquidity. This alternative financing method allows businesses to leverage their assets—typically their vehicle—as collateral in exchange for a cash advance. It’s important to understand that this process involves borrowing against the future sale of said asset, meaning the business must be prepared to repay the loan promptly or face potential loss of ownership.

In the case of Houston Title Loans, the process begins with an assessment of your vehicle’s valuation. This appraisal determines the maximum amount you can borrow based on the market value of your vehicle. Unlike traditional loans, which often require extensive paperwork and credit checks, title loans offer a streamlined approach, making them appealing for those in need of rapid financial support. However, it’s crucial to be mindful of the interest rates and repayment terms associated with these loans, as they can vary significantly between lenders.

Common Pitfalls to Avoid When Taking Out a Business Loan

When considering a title loan for business expenses, it’s crucial to be aware of potential pitfalls that can significantly impact your financial health. One common trap is underselling the value of your assets; always ensure an accurate assessment to avoid borrowing more than necessary. Additionally, rushed decisions can lead to unfavorable loan terms, including high-interest rates and rigid repayment schedules. It’s essential to take time, understand various loan requirements, and explore different repayment options before committing.

Another pitfall involves neglecting to budget for unexpected expenses that might arise during the loan period. Maintaining emergency funds can provide a safety net and prevent you from falling further into debt. Moreover, be vigilant about hidden fees and charges associated with title loans, as these can quickly add up. Understanding your financial obligations and making informed choices will help navigate these challenges successfully.

Strategizing Repayment: Navigating Your Title Loan Responsibly

When considering a title loan for business expenses, strategizing repayment is paramount to navigating this financial tool responsibly. It’s important to have a clear plan in place before securing such a loan. First, assess your cash flow and determine how much you can comfortably allocate towards monthly payments. Remember that timely repayment not only ensures good credit standing but also saves you from accumulating interest charges.

In San Antonio Loans, secured loans like title loans often come with flexible terms and rates. However, it’s crucial to aim for faster payoff to minimize the overall cost. A strategic approach involves setting up automated payments or enrolling in automatic loan payoff plans offered by lenders. This streamlines the process, making repayment seamless while potentially reducing penalties associated with late fees.

When considering a title loan for business expenses, understanding both its benefits and potential pitfalls is crucial. By carefully navigating repayment strategies and avoiding common traps like excessive borrowing or missing payments, entrepreneurs can leverage this alternative financing method to fuel growth while maintaining financial responsibility. Remember that proactive management and a solid plan are key to ensuring a successful and sustainable business journey.