Title loans for business expenses provide a fast cash solution for entrepreneurs with limited funding options, using future revenue or assets as collateral. This option is ideal for urgent business needs like inventory or unexpected costs, offering simpler requirements and potentially lower interest rates than short-term alternatives. However, weigh the benefits against high-interest rates and short repayment periods; explore traditional bank loans or grants first to ensure the best financial outcome.

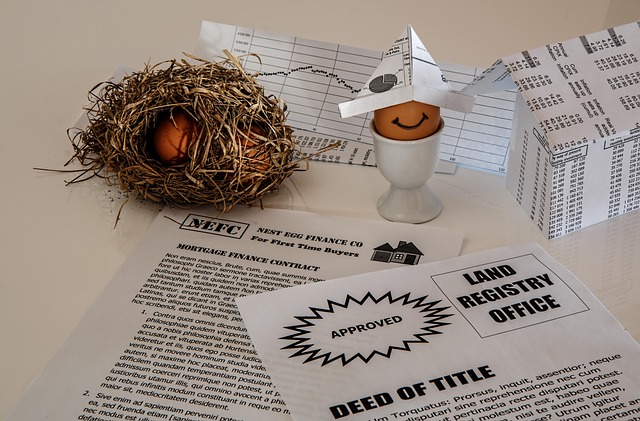

In today’s dynamic business landscape, entrepreneurs often seek innovative financing solutions. A title loan for business expenses emerges as a unique option, offering a quick cash infusion secured against an asset—typically a vehicle. This article delves into understanding title loans and their role in filling temporary financial gaps. We explore when this alternative funding source makes fiscal sense, considering both advantages and potential drawbacks to help businesses make informed decisions.

- Understanding Title Loans: Unlocking a Unique Financial Tool

- When is a Title Loan for Business Expenses Suitable?

- Navigating the Pros and Cons: Weighing Your Options

Understanding Title Loans: Unlocking a Unique Financial Tool

Title loans for business expenses represent a unique financial tool that can provide entrepreneurs with fast cash when traditional funding options are scarce. This type of loan uses a business’s title or future revenue as collateral, allowing businesses to access capital quickly and easily. Unlike other loan types, title loans often have simpler loan requirements, focusing primarily on the value of your business assets rather than your personal credit history.

This financial strategy can be particularly beneficial during unforeseen circumstances, such as unexpected cash flow shortages or emergency business expenses. By tapping into the equity of their business, owners can secure a loan with potentially lower interest rates compared to other short-term financing options. Understanding this innovative solution empowers business leaders to navigate financial challenges and seize opportunities without being held back by traditional banking constraints.

When is a Title Loan for Business Expenses Suitable?

A Title Loan for Business Expenses can be a suitable financial solution when a business owner faces immediate and substantial cash flow needs. This type of loan is particularly beneficial in scenarios where traditional financing options are limited or not readily available, such as in the case of new businesses with no established credit history or enterprises experiencing seasonal fluctuations in revenue. It offers a quick way to access funds, ensuring that businesses can meet urgent expenses like inventory purchases, equipment repairs, or unexpected operational costs.

For entrepreneurs with collateral in the form of vehicle ownership, a Title Loan provides an attractive alternative to bad credit loans. These loans offer flexible payment plans, allowing business owners to pay back the loan at their own pace without the pressure of stringent repayment terms. This accessibility makes it an appealing option for those seeking fast cash to navigate through challenging financial periods or unexpected business setbacks.

Navigating the Pros and Cons: Weighing Your Options

When considering a title loan for business expenses, it’s crucial to weigh both the pros and cons carefully. A title loan, like San Antonio Loans or Motorcycle Title Loans, offers quick access to cash by using your vehicle’s title as collateral. This can be particularly appealing when you need funds urgently, such as for unexpected business expenses or opportunities that require immediate capital. The lender provides a direct deposit of the loan amount into your account, making it an attractive option for businesses in need of fast funding.

However, it’s important to remember that these loans come with risks. High-interest rates and short repayment periods can make them challenging to repay, especially if your business experiences unexpected setbacks. Additionally, failure to repay the loan on time could result in losing your vehicle’s title. It’s essential to thoroughly evaluate your financial situation and explore other funding options, such as traditional bank loans or small business grants, before deciding on a title loan for business expenses.

In conclusion, a title loan for business expenses can be a strategic financial decision for entrepreneurs facing immediate cash flow challenges. By understanding the unique aspects of these loans and carefully considering their benefits and drawbacks, business owners can unlock a powerful tool to navigate through tough times. Weighing the pros and cons will help determine if this alternative financing option aligns with individual needs, ensuring informed decisions in today’s dynamic business landscape.